Wondering if you are eligible to become a member at Heritage? Use the quiz below.

A totally free checking account with no service charge or minimum balance requirements.

If you're a current member and are interested in opening a Free Access Account, we recommend going through digital banking so your information is pre-filled.

Open a Free Access Checking Account!

Or, choose to utilize your debit card and open a free account that earns high dividends or rewards!

Free checking that pays cash back refunds on your debit card purchases and ATM withdrawal fees.*

Includes exclusive access to open a free Kasasa Saver® account to collect and grow your Kasasa Cash Back rewards effortlessly.

If you're a current member and are interested in opening a Kasasa Cash Back Account, we recommend going through digital banking so your information is pre-filled.

Free checking that earns really high dividends plus other rewards like refunded ATM withdrawal fees.*

Includes exclusive access to open a free Kasasa Saver® account to collect and grow your Kasasa Cash rewards effortlessly.

If you're a current member and are interested in opening a Kasasa Cash Account, we recommend going through digital banking so your information is pre-filled.

We recommend an auto loan. At Heritage, we have auto loans for YOU.

We recommend a recreational loan. At Heritage, we have recreational loans for YOU.

We recommend a home loan. From Conventional to Zero Down to VA/FHA/USDA, we have a mortgage designed for YOU.

We recommend a personal loan. At Heritage, we have personal loans for YOU.

We recommend a credit card. At Heritage, we have instant issue credit cards that you can pick up at a branch as soon as today!

We recommend a home equity line of credit. What is home equity? It’s the current value of your home minus your mortgage balance. With a home equity loan, you can borrow against that equity and use the money for a variety of purposes.

You may need a personal loan, a credit card, or a home equity loan. We recommend connecting with a loan officer for the best recommendation.

Please get the title to Heritage Federal Credit Union. You may bring it to any one of our branch locations or mail it to PO BOX 189 Newburgh, IN 47629.

Take the title to your local BMV to change the ownership of the vehicle. (This will require a signature or documentation from the previous owner, check with the BMV for any requirements.) At the BMV you can list Heritage Federal Credit Union as lienholder using the following address PO BOX 189 Newburgh, IN 47629. Once complete get a copy of the titling receipt to Heritage Federal Credit Union, please bring it to any one of our branch locations, Mail it to PO BOX 189 Newburgh, IN 47629, Fax it to 812-853-1742, E-mail it to titles@heritagefederal.org.

Contact the previous financial institution and confirm if, when, and where the title was sent. If the title was sent and not received by Heritage, request a lien release to be sent to Heritage. Please mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

The dealership should have submitted appropriate documentation to the BMV. When you register and plate your vehicle, the BMV will send the title to Heritage Federal Credit Union. Once you have registered and plated the vehicle, provide a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org

The seller of the vehicle should provide the original title and sign the back of the title as seller. Once you obtain the title, take the title to your local BMV to change the ownership of the vehicle. At the BMV, list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org

Contact the previous financial institution and confirm if, when, and where the title was sent. If the title was sent and not received by Heritage Federal Credit Union, request a lien release be sent to Heritage Federal Credit Union using one of the following methods: mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org

If Heritage Federal Credit Union is not listed as first lien holder, you may bring the original title to Heritage so that we may send it to the county clerk to add our lien. If Heritage Federal Credit Union is listed as first lien holder, get a copy of the title to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, Fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office, not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

Take the title to your local county clerk's office to change the ownership of the vehicle. (This will require a signature or documentation from the previous owner, check with the county clerk's office for any requirements.) At the county clerk's office, please list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org. Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

Contact the previous financial institution and request a lien termination statement. Take the lien termination statement to your local county clerk's office to request a duplicate title. Ask the county clerk's office to list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org. Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office, not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

The dealership should have submitted the appropriate documentation to your local county clerk's office. When you register and plate and your vehicle, the county clerk's office will send the title to your home address and if Heritage Federal Credit Union is appropriately listed as lien holder, we will recieve the required notice. Once you have registered and plated the vehicle, please provide a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org. Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office, not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

The seller of the vehicle should provide the original title and sign the title as seller. Once you obtain the title, take it to your local county clerk's office to change the ownership of the vehicle. At the county clerk's office, list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org. Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office, not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

Contact the previous financial institution and request a lien termination statement be sent. Take the lien termination statement to your local county clerk's office to request a duplicate title. Ask the county clerk's office to list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, e-mail it to titles@heritagefederal.org, Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office, not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky title.

Correspond with the IL Secretary of State Office to add Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete get a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to any one of our branch locations, email it to titles@heritagefederal.org, fax it to 812-853-1742, or mail it to PO BOX 189 Newburgh, IN 47629.

Take the title to your Secretary of State Office to change the ownership of the vehicle. (This will require additional documentation, check with the IL SOS for any requirements.) List Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629.

Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

At your local Secretary of State Office, request a duplicate title, and list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete get a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to any one of our branch locations, email it to titles@heritagefederal.org, fax it to 812-853-1742, or mail it to PO BOX 189 Newburgh, IN 47629.

At your local Secretary of State Office, request a duplicate title and ask the Secretary of State Office to list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Contact the previous financial institution and confirm if, when, and where the title was sent. If the title was sent and not received, request a lien release. Correspond with the Illinois Secretary of State to order a title with Heritage Federal Credit Union listed as the first lien holder using the following as the lienholder address: PO Box 189 Newburg, IN 47629.

Once complete, get a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Follow up with the dealership you purchased the vehicle from. The dealer will have either: (1) submitted appropriate documentation to the Secretary of State on your behalf or (2) provided you documentation to submit to the Secretary of State. This documentation should list Heritage Federal Credit Union as the lien holder, which will prompt the Secretary of State to mail the title to PO Box 189 Newburgh, IN 47629.

If you can obtain a copy of the titling receipt, get it to Heritage Federal Credit Union. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

The seller of the vehicle should provide the original title and sign the title as seller. Once you obtain the title, take it to your local Secretary of State Office to change the ownership of the vehicle and list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Contact the previous financial institution and confirm if, when, and where the title was sent. If the title was sent and not received, request a lien release to be sent. Correspond with the Illinois Secretary of State to order a title with Heritage Federal Credit Union listed as the first lien holder using the following as the lienholder address: PO Box 189 Newburg, IN 47629

Send a copy of the titling recepit to Heritage using one of the following methods: mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Correspond with your state or county titling office to get the vehicle titled and registered in your name. Add Heritage Federal Credit Union as lien holder, please use the following for the lienholder address: PO Box 189 Newburgh, IN 47629.

Once complete get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742 or e-mail it to titles@heritagefederal.org.

At your local state or county titling office, request a duplicate title. Ask the BMV to list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage, please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

The seller of the vehicle should provide the original title and sign the title as the seller. Once you obtain the title, take it to your local state or county titling office to change the ownership of the vehicle, and list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage. Please bring it to any of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Contact the previous financial institution and confirm if, when, and where the title was sent. If the title was sent and not received, request a lien release be sent. Correspond with your state or county titling office to get the vehicle titled and registered in your name, and add Heritage Federal Credit Union as the lien holder witht he following address: PO Box 189 Newburgh, IN 47629

Once complete, get a copy of the titling receipt to Heritage using one of the following methods: mail it to PO BOX 189 Newburgh, IN 47629 , fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org.

Contact your previous financial institution to verify if, when, and where the title was sent. If the title was sent and not received, request a lien release. Correspond with your state or county titling office to apply for a title with Heritage Federal Credit Union listed as the lien holder. Please use the following for the lienholder address: PO Box 189 Newburgh, IN 47629.

Once complete, send a copy of the titling receipt to Heritage. Please bring it to any of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or email it to titles@heritagefederal.org.

At your local county clerk's office, request a duplicate title and ask the county clerk's office to list Heritage Federal Credit Union as lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete get a copy of the titling receipt to Heritage. Please bring it to any one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, e-mail it to titles@heritagefederal.org. Kentucky is NOT a title-holding state, which means titles are sent to owners by county clerk’s office not the lien holders. In place of the title, the lien holder receives a lien statement with a lien filing number and lien filing date. This information can also be found printed on the front of the Kentucky Title.

At your local BMV, request a duplicate title and ask the BMV to list Heritage Federal Credit Union as the lienholder using the following address: PO BOX 189 Newburgh, IN 47629. Once complete, get a copy of the titling receipt to Heritage Federal Credit Union. Please bring it to one of our branch locations, mail it to PO BOX 189 Newburgh, IN 47629, fax it to 812-853-1742, or e-mail it to titles@heritagefederal.org

You qualify to be a member at Heritage! Get started today.

We apologize but at this time you do not qualify to be a member at Heritage. We are always expanding so please check back in the future.

If you think this is incorrect, or if you would like more information, please contact us.

Let's get that account opened. If you currently have digital banking, we recommend logging in and opening an account there so your information is pre-filled.

If you do not have digital banking, use the button below.

Get ready to enjoy your new favorite account.

If you're not sure if you qualify for membership, click here. If you need additional help deciding which account is for you, use our checking selector tool.

Not sure if you're currently a member? No worries! A member is anyone who has any deposit or loan accounts at Heritage. You can find out if you're a member by contacting a member of our team, here.

Test Product copy yayy

Congrats! You finished my decision tree. See it wasn't that bad after all.

Even though you cliked no, you still anwsered the question. Guess you couldn't really get out of participating in the decision tree, so you can be slay after all. Congrats!

Free checking that earns really high dividends plus other rewards like refunded ATM withdrawal fees.*

Includes exclusive access to open a free Rewards Savings account to collect and grow your rewards effortlessly.

If you're a current member and are interested in opening a Rewards Checking Account, we recommend going through digital banking so your information is pre-filled.

Free checking that pays cash back refunds on your debit card purchases and ATM withdrawal fees.*

Includes exclusive access to open a free Rewards Savings account to collect and grow your rewards effortlessly.

If you're a current member and are interested in opening a Rewards Cash Back account, we recommend going through digital banking so your information is pre-filled.

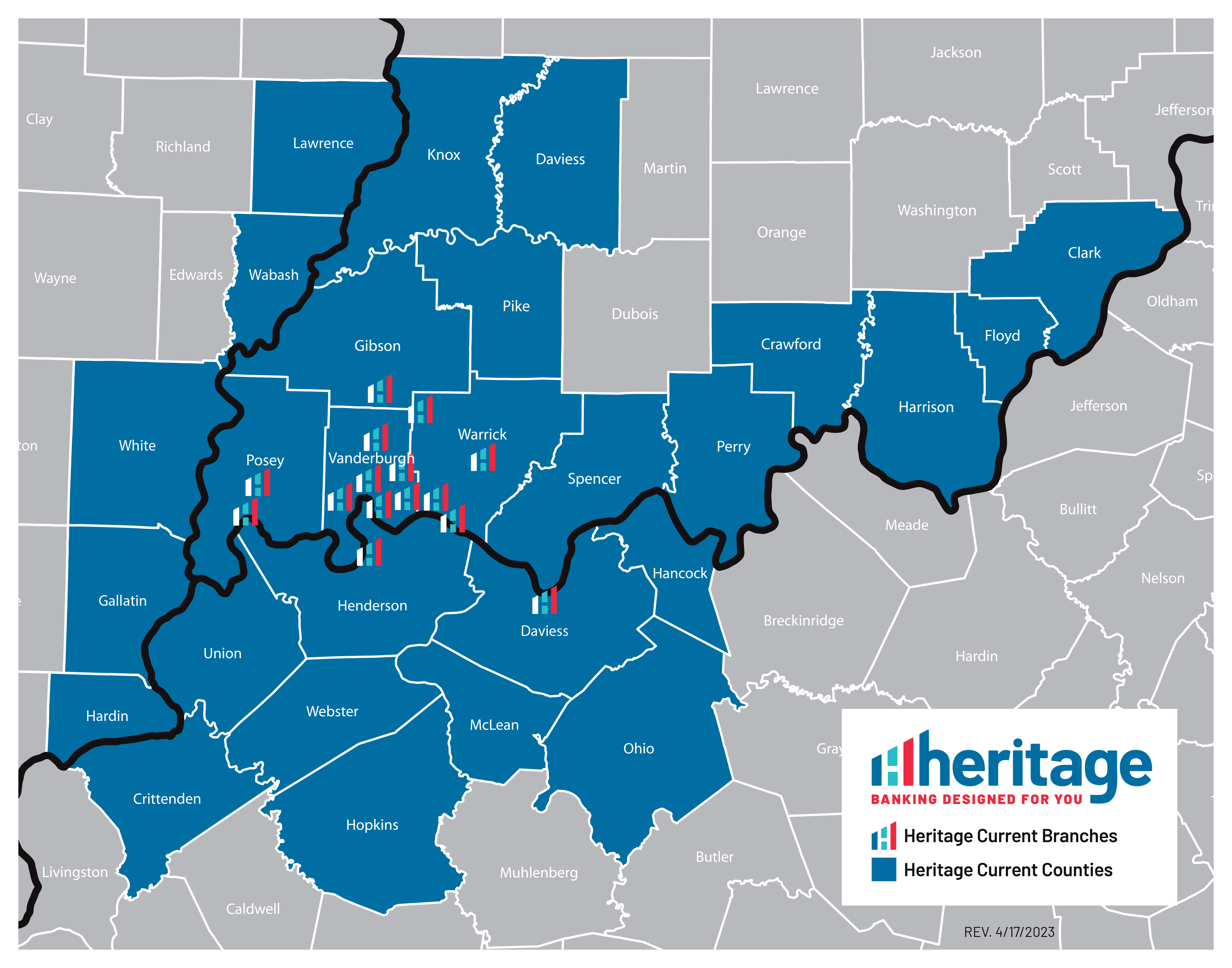

Field of Membership Counties

- INDIANA - Gibson, Posey, Warrick, Vanderburgh, Davies, Knox, Spencer, Pike, Perry, Crawford, Clark, Floyd, Harrison

- KENTUCKY - Henderson, Daviess, Hopkins, Hancock, Ohio, McLean, Webster, Union, Crittenden

- ILLINOIS - Lawrence, Wabash, White, Gallatin, Hardin

Membership Eligibility

Membership Eligibility is limited to:

- Anyone who lives, works, worships, or attends school in field of membership counties.

- Anyone who has an immediate family member that is a current member, or resides in the same household as a current member of Heritage.

- Heritage employees.

Business Eligibility

Business Membership Eligibility is limited to businesses located in field of membership counties.

If you have additional questions, please use the chat feature below during normal business hours, or see the contact us page.

Go to main navigation